Shanghai-Hong Kong Stock Connect

Shanghai-Hong Kong Stock Connect

Shanghai-Hong Kong Stock Connect is a cross-boundary investment channel that connects the Shanghai Stock Exchange and the Hong Kong Stock Exchange. Under the program, investors in each market are able to trade shares on the other market using their local brokers and clearing houses. Chinese Premier Li Keqiang said this connection program helps to open the Chinese capital market to international market and helps both Shanghai and Hong Kong to develop healthy. The program has successfully launched on 17 November 2014.

Since 17 November 2014, the connection program has operated very steadily for over three years, businesses such as transactions, registration and settlement, currency exchange and different corporate actions have smoothly been handled. up to March 30, 2018, the data has shown that the Shanghai-Hong Kong Stock Connect

Program has reached trade revenue of 7.8 trillion rmb, 795 stocks have been trade from the northbound trading with trade revenue 4.3 trillion rmb and 385 stocks have been trade from southbound trading with trade revenue 3.5 trillion rmb.

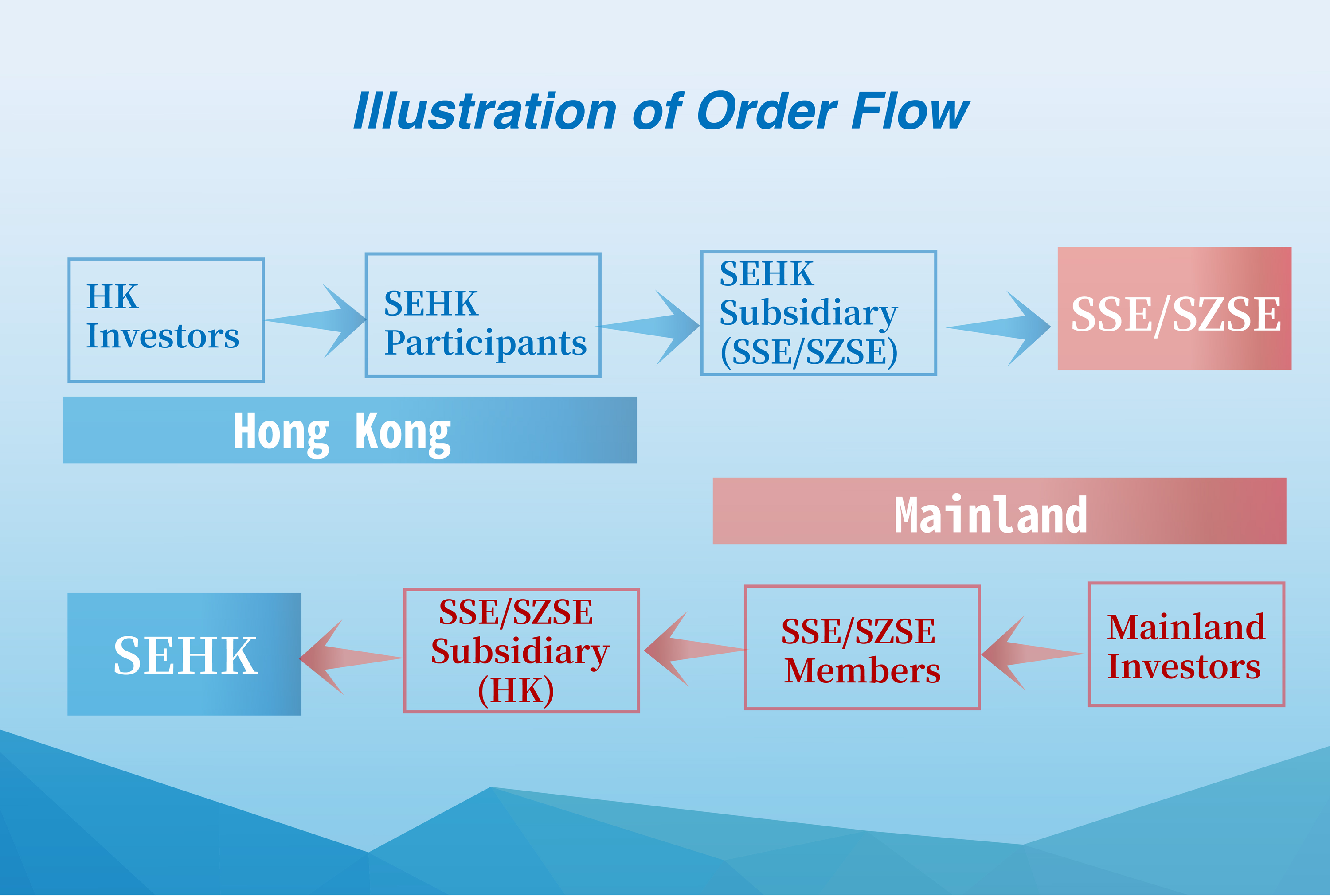

The Shanghai-Hong Kong Stock Connect program is divided into two parts Shanghai connects and Hong Kong connects:

Shanghai connect allows investors entrust Hong Kong Stock brokers to trade A stocks that listed in Shanghai stock exchange Centre by securities company that set up by HKEx

Hong Kong connects allows investors entrust Mainland Stock brokers to trade Hong Kong stcoks that listed in Hong Kong stock exchange Centre by securities company that set up by Shanghai Exchange centre.

Shanghai-Hong Kong Stock Connect is an important step to the Chinese capital market to become global. It helps to strengthen the capital market linkage between Mainland and Hong Kong. There are three positive impacts: first, this cooperation program enhances the strength of the Chinese capital market. Second, it strengthens the financial Centre position of both Shanghai and Hong Kong, and to increase the attractiveness for international investors to invest in these two cities, also it can improve the investor structure of shanghai capital market so to further advance Shanghai becoming international financial Centre; at the same time, Hong Kong can became the mainland Chinese oversea international in order to enhance Hong Kong position of international financial Centre. Third, it can also help the internationalization of Renminbi, and potentially develop Hong Kong into oversea Reminbi trading Centre. The Shanghai-Hong Kong Stock Connect program allows Chinese investors to invest in Hong Kong capital market directly in Renminbi and an extra investment channel for Reminbi investment.

As a member of the Hong Kong Securities and Future Commission Public register of registered institutions, CNI has the advantage on rich experience on investment and familiar with economic development in China. We will fully cooperate with the needs of the market to help our customers achieve high return.

STOCK CONNECT (NORTHBOUND)

Trading is conducted on Monday to Friday (excluding non-Northbound Trading days) at the following times:

|

|

SSE/SZSE Trading Hours |

Time for EPs to input Northbound orders(1) |

|

Opening Call Auction |

9:15 a.m. - 9:25 a.m. |

9:10 a.m. - 11:30 a.m. |

|

Continuous Auction (Morning) |

9:30 a.m. - 11:30 a.m. |

|

|

Continuous Auction (Afternoon) |

1:00 p.m. - 2:57 p.m. |

12:55 p.m. - 3:00 p.m. |

|

Closing Call Auction |

2:57 p.m. - 3:00 p.m. |

Note (1):

| Time Period | Remarks |

| 9:20 a.m.– 9:25 a.m | SSE/SZSE will not accept order cancellation |

| 2:57 p.m.– 3:00 p.m | SSE/SZSE will not accept order cancellation. |

| 9:10 a.m. – 9:15 a.m.; 9:25 a.m.– 9:30 a.m.; 12:55 p.m.– 1:00 p.m |

Orders and order cancellations can be accepted by SEHK but will not be processed by SSE/SZSE until SSE’s and SZSE's market open. |

Orders that are not executed during the opening call auction session will automatically enter the continuous auction session.

繁體中文

繁體中文 English

English